Which One Of These Is Fraud Using The Cash Register? Exam

While impersonation scams are certainly not new, at that place are surprising new variants every day. In a February 2021 study, FINRA observed an increment in cyber-related incidents, including fraudsters creating fake websites using the names and professional details of actual industry professionals (who have no connection to the imposter sites). And more recently, the FBI and Securities and Exchange Commission issued a warning to investors about this trouble.

Impersonation is i of the oldest scams, just it tin can be difficult to spot unless you know what you're looking for. Here are 2 patterns to be enlightened of and six tips to help spot the fakes.

Imposter Websites

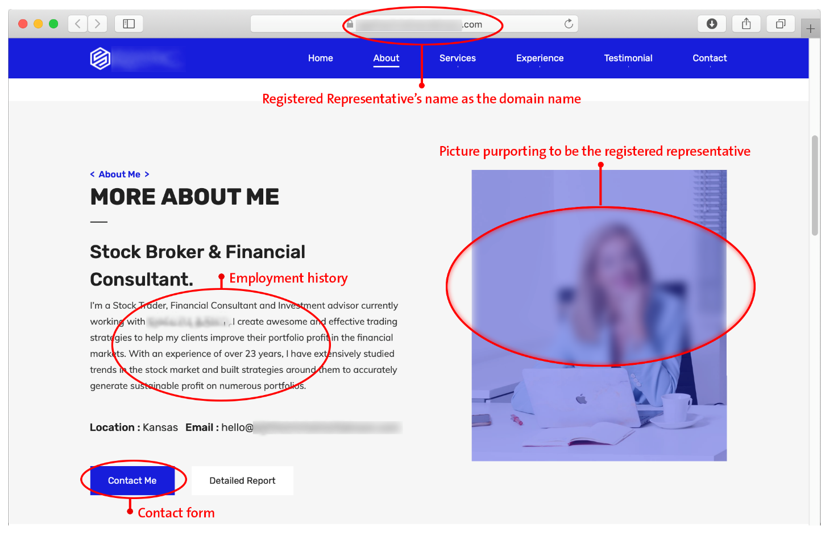

The fraudsters behind broker imposter websites take the name and other publicly available professional details virtually a registered investment professional person and employ this information to found a fraudulent website. The fraudsters then call and direct potential customers to the imposter websites. Their likely goal is to mimic a legitimate website to obtain existing or potential clients' personal information or login credentials.

Investors should look for the typical mistakes, such as poor grammar, misspellings, odd or bad-mannered phrasings, or misuse of investor terminology. In add-on to these, investors should be on the lookout for websites using the registered representative's proper noun as the domain name for the website (e.g., firstnamemiddlenamelastname.com).

Imposter Documents

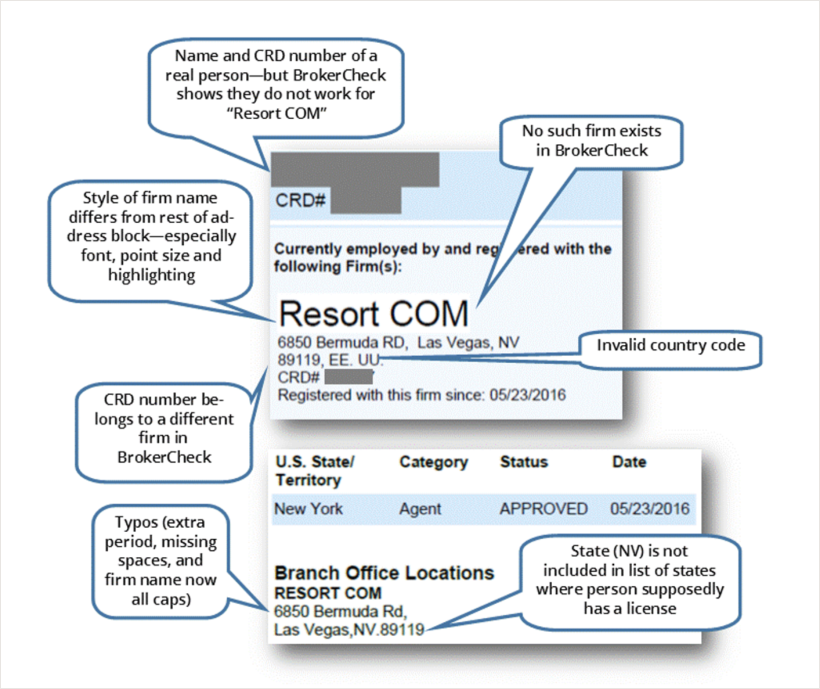

Another blazon of broker imposter scheme involved an unregistered individual impersonating a registered investment professional to lure in potential investors. In this instance, the scammer created a fake version of a public FINRA BrokerCheck® written report of a legitimate broker—picking an experienced broker with a spotless regulatory record.

The doctored BrokerCheck report was emailed to potential "clients" using the name and CRD number of a registered investment professional—but with a visitor that is non registered as a broker-dealer with FINRA. The solicitation included other documentation and a request for investors to respond with a photograph of their driver's license and other personal data.

Here are some of the red flags we spotted on the doctored report:

To keep your money and personal data safe from these types of scams, take these half dozen tips to eye.

ane. Go to the source. FINRA encourages investors to "ask and check" by using BrokerCheck before investing with an investment professional person. Don't presume that the information you receive is legitimate. Go directly to the sources that collect the regulatory information to produce these reports, including FINRA'due south BrokerCheck, the SEC's Investment Adviser Public Disclosure, and state registration databases. You tin can search both professionals and firms non only by name, but besides by their registration number—known as a CRD number.

2. Look for things that appear out of place.Compare whatever BrokerCheck report or other documentation you receive from an individual or firm soliciting your business concern with the real reports you lot obtain yourself from BrokerCheck or the sources above. Exist wary of typos, and wait for differences in the reports. For instance, in a contempo scam, the doctored information was in fonts that were dissimilar from fonts used in other parts of the written report, items appeared to exist pasted into the document, and the state of the branch office address was not included in the list of states where the individual was licensed.

3. Verify information with an internet search. Accept a few moments to use a common search engine to type in the name of the individual who is soliciting your business concern and the firm name, and see what comes up. Does it lucifer the data provided to you, including the contact information? If something doesn't await right, do a little more than earthworks, including a map search on the address or a reverse lookup on the phone number. Exist sure to cheque all this information against a reliable source such every bit BrokerCheck, where you tin can verify whether the phone number or website listed in the firm's Client Relationship Summary (Form CRS) matches. When scanning LinkedIn profiles, be aware that scammers oftentimes copy select data from a registered person's LinkedIn profile to create the advent of legitimacy.

4. Practise non ship money or personal information without verifying the recipient. Don't always send money or personal information, such equally your driver's license, passport, social security number, date of nativity, or depository financial institution account data, until you lot verify who contacted you.

5. Beware of the utilize of personal contact information. Sometimes a scammer will ask you to transport money or personal information to a personal (rather than a business firm'southward) email address or to reply to phone numbers that are not listed every bit official firm contacts. One general dominion all investors should follow: if y'all invest through an account at a financial firm, use BrokerCheck to verify that the business firm is registered and send all deposits directly to the financial house. If an individual pitches an investment opportunity that requires you to write a bank check directly to him or to a third party, go on with circumspection.

half-dozen. Be alert to the red flags of fraud. Exist cautious of guarantees, unregistered products, overly consistent or loftier returns, circuitous strategies, missing documentation, account discrepancies and pushy salespeople. The vast majority of investment professionals are trustworthy individuals, but there are always exceptions who might await to take advantage of your trust. Practise spotting the persuasion tactics that con artists use, and e'er exercise healthy skepticism. For case, exist wary of sales pitches that brand exaggerated claims about operation. This is a cherry flag of fraud.

If you lot are suspicious nigh information you receive from an individual or firm soliciting your business organization, contact FINRA or another regulator BEFORE yous send any personal or financial information. If you are an investment professional and take concerns that someone is using your name or information every bit office of a potential scam, contact your firm'southward compliance department, and warning FINRA past calling our BrokerCheck hotline at (800) 289-9999, or emailing[email protected].

Which One Of These Is Fraud Using The Cash Register? Exam,

Source: https://www.finra.org/investors/insights/broker-imposter-scams

Posted by: moralesoure1974.blogspot.com

0 Response to "Which One Of These Is Fraud Using The Cash Register? Exam"

Post a Comment